10 STEPS

Once your contracting is complete, you will receive many emails from Symmetry and then more emails from Carriers. Be sure not to miss any of these important steps that they email to you (be sure to copy and paste each username, password, and agent number you receive from each email into a Google Doc). Keep every email you receive from here on out as you’ll be asked to retrieve several of them in the coming months.

You will receive emails from AgentSync Contracting. Here’s an Overview AgentSync and How to use AgentSync.

Step 1: Set up an account with Quility

- Navigate to hq.quility.com.

- Click “Reset your Password.”

- Enter the same e-mail address you used in the Onboarding Portal and then click “Password Reset.”

- You will receive a confirmation message

- Navigate to and click on the grid in the top left corner. Launch OPT!.

- Proceed to use the Name and Password provided in the email these instructions were attached to. It may look like this:

Login Name: ERINDR09

Temporary Password: 11332200

Questions? Ask your upline. In case of absolute emergency, 1-828-581-0475 or help@quility.com

Step 2: Begin Symmetry Orientation (“Summit”)

The company orientation and training will take approximately 8 hours to complete:

- Visit https://hq.quility.com/

- On left column, select “training”

- At the bottom of the page, select the Summit link.

- Click “start training”

After Summit

Request access to Switchboard, using the directions here.

Step 3: AntiMoney Laundering

Training is required – and free.

- https://knowledge.limra.com/LimraLogin.aspx

- Enter your LIMRA username — it is your National Producer Number (NPN); your password is your last name in all lower case (you may look up your NPN on NIPR’s website with the provided link. https://nipr.com/help/look-up-your-npn

- Courses Required: First time users: Anti-Money Laundering for Insurance Producers

- Once completed, keep the email that confirms your completion. You’ll use it down the road.

OLD LINK: https://www.webce.com/catalog/courses/course-information/aml-training/course/206954

Step 4: Consider Signing up for Errors and Omissions Insurance

It’s highly suggested that you purchase Errors and Omissions Insurance from CalSurance Associates (Cost: $35/mo). You’ll be offered this insurance along the way, but you can also visit https://www.calsurance.com/lh to get the ball rolling. This will protect you if you make errors or omissions as you write business.

- Forresters: E&O insurance is not required for Strong Foundation or PlanRight, but required for all other Foresters products.

- American Amicable: E&O insurance is not required.

- Mutual of Omaha: E&O insurance is not required to write Living Promise, Children’s WL, Term Life Express, Guaranteed Advantage, Med Supp, and GIUL Express, but is required for all other Mutual of Omaha products.

- Americo: E&O insurance is not required for Final Expense or Medicare Supplement products, but is required for other Americo products.

Once purchased, keep the email that confirms your payment and certificate. You’ll use it down the road.

Step 5: Contract with each carrier

View their training videos Overview AgentSync and How to use AgentSync.

In case you need it, the Shank Agency number/code is 007HW. You’ll need to confirm with your up-line for each request.

Questions? Create a ticket at https://hq.quility.com/support (the blue button on the right that says “Submit a Support Ticket) or you can send an email to help@quility.com

To familiarize yourself with different products we will offer to our prospects: https://hq.quility.com/training/product-concepts (there are different categories of products we offer at the top of the page).

Use each carrier’s website to order brochures and materials (free) if you plan on meeting prospects in person. You can call them or you can order online through https://hq.quility.com/support.

Step 6: Bookmark Resources (you’re not alone!)

In addition to asking your upline for help or advice, there’s a very active Facebook group with over 4,000 agents that are eager to help: https://www.facebook.com/groups/282509645694733

Jump into Slack (if you can’t find the email they sent, let your upline know).

Other States

You will will want to get licensed in other states (more poles in the water means more fish). You will use https://nipr.com (Questions? (855) 674-6477.). Some of the least expensive states with large inventories of leads are Iowa, Ohio, Texas, Virginia, South Carolina, New Mexico, Michigan. Florida is great as well. Ask your upline or check Opt! to see which states have the largest inventory. It’s nice to have different time zones so you can dial more often during your workday.

Step 7: Zoom and Email Set Up

Many appointments occur over zoom (some occur in people’s homes as well). You’ll need to register for a free Zoom account here: https://zoom.us/freesignup/

You may want to consider setting up a professional email signature. You can create that in gmail, or you can use a free third party like https://www.wisestamp.com/ If you are interested in creating a non-gmail email…something like “George@ProtectUS.org” just ask your upline; it will be around $35/yr although using your own personal email is permissible.

Finally, you may need to register your phone so you’re not labeled as spam down the road once you start texting/dialing:

- Verizon: https://voicespamfeedback.com/

vsf/ - AT&T: https://hiyahelp.zendesk.com/h

c/en-us/requests/new?ticket_fo rm_id=824667 - T-Mobile/Sprint: https://calltransparency.com/

- Sprint, Verizon, U.S. Cellular, Comcast, Charter, Cox, Altice and other fixed line (VoIP) providers: https://Reportarobocall.com

- One more: https://www.freecallerregistry

.com/fcr/

Step 8: While you’re waiting to get contracted with the carriers

- Fun facts about Insurance: https://statehq.org/funfacts

- Use recordings as part of your training.

- Watch this recording more than once:

Step 9: Practice

- Memorize everything at https://statehq.org/nepq.

- The Scripts: Phone script and the In-home presentation.

- Here’s why you need to learn the script.

- Scroll to the bottom of this page and find, “Jeremy Miner 8-Week NEPQ Training” and, as time permits, start listening: https://hq.quility.com/page/calls-and-webinars.

- Record yourself following the script and see if you sound natural. Send a copy to your upline to review.

- Practice filling out a basic final expense app here: https://scdemo.americo.com/

- Reach out to your Up-line and have them practice the script with you.

- Learn about Quility RX so you can save your clients money on prescriptions and earn passive income: https://rx.quility.com/

Step 10: Triple Check

Be sure that you:

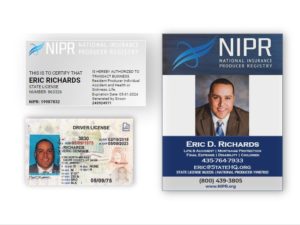

- Have your National Producer Number and State Agent Number in a safe (retrievable) place.

- Have your license, RX Cards, and business cards designed. Here’s a Template (NOTE: your BIN and other info for your Quility RX Cards are found at www.myquility.com

- Have a picture of your State License,Business card, and your Driver’s license on your phone to text to people so they can verify your identity (you can blur out your DL number).

Can login here: https://hq.quility.com/

Can login here: https://hq.quility.com/- Know where your Anti Money Laundering and E&O proof or certification are.

- Are familiar with the tonality at https://statehq.org/nepq and are planning on practicing 10+ mins each day using www.statehq.org/prep

- Bookmark this and complete your Jeremy Miner listening (toward the bottom of the page): https://hq.quility.com/page/calls-and-webinars

- Understand that we typically lead with Living Benefits with term policies – and you know the difference between Straight Life policies and policies that have Living Benefits.

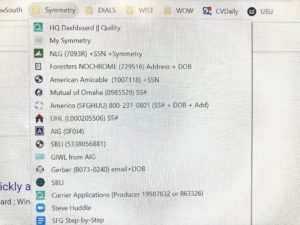

- Can login to each of the Carrier’s website here (that you are contracted with)

- Foresters

- American Amicable

- Mutual of Omaha

- Americo

- UHL

- SBLI

- AIG

- NOTE: You can write with American Amicable and MOO before you are onboarded with them. Go to HQ > Carriers & products dropdown on the left > Select Mutual of Omaha > Scroll all the way down to the “Just in time” link > It will show the step by step directions.

- Can send a link to your Zoom Room using your professional email address.

- Have listened to this more than once.

- Have begun the process to get Switchboard set up.

- Are ready to puchase leads.

- Have a daily schedule set.

- Have a weekly schedule that includes:

- Wednesday Huddle

- 12pm EST Friday Tarr Agency meeting

- Getting Call-in Leads from Opt Thursday & Friday nights, and Saturday mornings

- Tonality training with Eric

- A time to listen to 1-2 Call Recordings each week for your growth and learning.

- Have a system in place for following up with leads (Google Calendar? File folders labeled with days of the week? Something link this maybe) while using a pace and tonality like this.

- Have joined Slack.

- Have the following Tabs on your ComputerLeads: Opt!

-

- The Phone script

- The In-home presentation

- Casework Page: www.Statehq.org/casework

- Are ready to start making money helping families!

GROUPME and SLACK

You’ll see agents reporting the APV on their work using GroupMe; this stands for “Annual Premium Volume.” It’s the total amount that the client pays into the policy each year. You will receive around 70% of that as your commission in two increments: 75% of the 70% upfront and then the last 25% in months 10-12 of the contract. For example, if the APV is $1000, you’ll be receiving $700 of that money in two payments – $525 upfront and the remaining $175 in months 10-12.

You’ll also see numbers like “50/10/5”. This configuration of numbers reflects how many times numbers were dialed (50); how many contacts were made (10); and how many appointments were set (5).

TRAINING: Don't Be Pushy

PRO TIP

Consider typing in your Agent Number with the name of the Carrier to bookmark in your web browser. This makes it easy to remember your Agent Number when contacting the carrier.